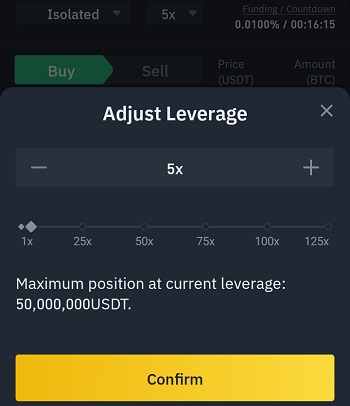

The biggest thing that hinders this type of trade in the USA market is the possession of licenses. Admittedly, that’s a tiny amount compared to leverage in other countries, but better anything than nothing. First and the most prominent among them is undoubtedly the Kraken, which offers 5x leverage for all trading pairs. Only a few platforms have licenses to trade in mild leverage. Therefore, only Bitcoin Futures Derivatives are allowed to be traded in margin trading. Digital assets are classified as commodities, not an official currency. Everything works well as long as crypto platforms are used as exchanges. Only simple buying and selling of cryptocurrencies in America are legal.

#Binance usa leverage license#

So, for example, brokers who trade in American derivatives have their platforms outside the borders of America and a license from, let’s say, the UK’s FCA or the competent authorities of other countries. However, trading in American assets and their derivatives with leverage on trading platforms is permitted as long as American citizens do not do so. So, if you have not sufficiently understood the operation mechanism of margin trading, it would be better to wait until you are ready before embarking on this business.Īs for the USA, we must emphasize that trading margins are prohibited in the USA because this type of trade mainly refers to CFDs, and CFD trading is not allowed in the USA. On the other hand, not to be negative, if you invest wisely and make smart moves, the money invested can bring huge profits.

That is why it is important to be well acquainted with this and possess specific knowledge before engaging in this type of trade.

#Binance usa leverage plus#

If the share price drops by 50%, it means that you have lost all the money, plus commissions and interest. Let’s explain with a simple example – you have your 10k USD + 10k USD that you borrowed and bought 2000 shares for 10 USD. If you are wondering why it is risky, simply put, you can lose a lot more than you invested. Still, it is also perilous to trade in this way. This loan assistance increases the purchasing power of the trader. At the very beginning, traders have to deposit money that acts as collateral for the loan and then regularly pay interest. Margin trading represents the borrowing of money from brokerage companies to trade.

Is Crypto leverage trading in the US allowed at all?

0 kommentar(er)

0 kommentar(er)